Fascination About Tax Amnesty

Wiki Article

Our Tax Accounting Ideas

Table of ContentsThe smart Trick of Tax Amnesty Meaning That Nobody is Talking AboutIndicators on Tax Avoidance You Should KnowThe Of Tax As Distinguished From License FeeTaxonomy for BeginnersExcitement About Tax As Distinguished From License Fee

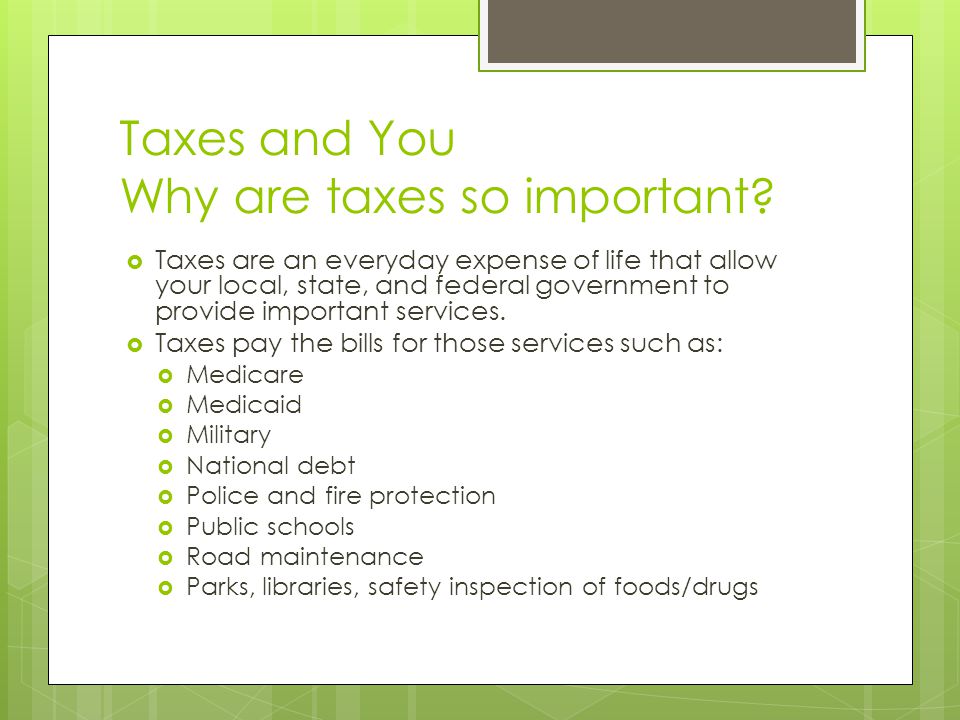

Governments impose costs on their residents and also services as a way of raising earnings, which is after that utilized to fulfill their monetary demands. This consists of financing federal government and public jobs as well as making business atmosphere in the nation conducive for economic development. Without taxes, federal governments would certainly be not able to fulfill the demands of their societies.

Good administration makes certain that the money gathered is made use of in a manner that benefits citizens of the nation. This money additionally goes to pay public servants, cops officers, participants of parliaments, the postal system, as well as others.

Aside from social tasks, federal governments likewise make use of money gathered from tax obligations to fund fields that are vital for the wellbeing of their residents such as security, clinical research, environmental management, and so on. Some of the cash is additionally carried to money tasks such as pensions, welfare, childcare, and so on. Without tax obligations it would be difficult for governments to raise cash to fund these kinds of jobs.

The Basic Principles Of Tax Avoidance

For organization to prosper in the nation, there needs to be great framework such as roads, telephones, electrical energy, and so on. This facilities is developed by federal governments or with close participation of the federal government. When governments collect cash from tax obligations, it ploughs this cash right into advancement of this framework as well as subsequently promotes financial task throughout the country.Tax obligations aid raise the standard of living in a country. The higher the requirement of living, the more powerful and higher the level of consumption more than likely is. Businesses grow when there is a market for their services and product. With a higher requirement of living, organizations would be guaranteed of a higher residential consumption.

This is why it is necessary that citizens venture to pay taxes and understand that it is indicated to be greater than simply a "money grab" from the government. CPA Business Consulting Building Your Monetary Success Relevance of Tracking Your Expenditures.

All about Tax

Note: the partnerships are substantial at the 1% level and remain significant when managing for income per head. The amount of the tax price for services matters for financial investment as well as growth. Where tax obligations are high, organizations are a lot more inclined to decide out of the formal sector. A study reveals that higher tax obligation prices are related to less formal services and lower private investment.Keeping tax rates at an affordable level can urge the development of the economic sector and the formalization of services. Moderate tax obligation prices are especially essential to small and medium-sizeenterprises, which add to financial growth as well as employment however do not include substantially to tax obligation revenue.7 Regular distributions of tax income by company size for economic climates in Sub-Saharan Africa and also the Center East as well as North Africa reveal that mini, small as well as medium-size ventures make up even more than 90% of taxpayers but add just 2535% of tax profits.8 Enforcing high tax expenses on companies of this size may not include much to federal government tax obligation earnings, but it may cause services to relocate to the casual industry or, even worse, discontinue operations.

The program reduced general tax obligation expenses by 8% as well as contributed to a boost of 11. 2% increase in the number of firms signed up with view the tax obligation authority.

Economic development frequently boosts the requirement for brand-new tax revenue to fund increasing public expense. At the exact same, time it requires tax base an economic situation to be able to satisfy those requirements. More crucial than the level of taxes, nevertheless, is just how income is made use of. In establishing economic climates high tax obligation rates and weak tax obligation management are not the only factors for low prices of taxation.

Some Known Details About Tax Avoidance And Tax Evasion

In Qatar as well as Saudi Arabia, it would certainly have to make 4 settlements, still among the most affordable on the planet. In Estonia, abiding by profit tax, value added tax obligation (VAT) and also labor taxes and also contributions takes just 50 hours a year, around 6 working days. Research study finds that it takes an Operating study business much longer on average to conform with VAT than to conform with business income tax obligation.Research study reveals that this is discussed by variants in management practices and in exactly how VAT is applied. Compliance often tends to take less time in economies where the exact same tax obligation authority provides barrel and corporate earnings tax. The usage of on the internet declaring and also repayment also substantially decreases compliance time. Frequency as well as size of VAT returns additionally matter; requirements to submit invoices or various other documentation with the returns include to conformity look at this site time.

Frequently, the challenge of taxation begins after the income tax return has been submitted. Postfiling processessuch as claiming a VAT reimbursement, undertaking a tax audit or appealing a tax assessmentcan be the most tough interaction that a company has with a tax obligation authority. Organizations might need to invest even more effort and time into the procedures occurring after declaring of tax returns than right into the regular tax obligation conformity treatments.

In concept, VAT's statutory incidence is on the final consumer, out businesses. According to tax plan standards laid out by the Organisation for Economic Co-operation as well as Advancement (OECD), a VAT system should be neutral and reliable. The lack of an effective barrel reimbursement system for organizations with an excess input barrel in a provided tax period will threaten this objective.

Rumored Buzz on Tax Amnesty 2021

Delays and also inefficiencies in the barrel reimbursement systems are often the result of worries that the system may be mistreated and prone to fraud.18 Moved by this issue, numerous economies have actually established actions to moderate and also limit the recourse to the barrel refund system and subject the refund claims to extensive procedural checks.The Working study company, Taxpayer, Co., is a residential organization that does not trade worldwide. It executes a basic industrial as well as commercial task and it remains in its second year of operation. Taxpayer, Co. fulfills the VAT threshold for registration and its monthly sales and also month-to-month overhead are taken care of throughout the year, causing a positive output VAT payable within each audit duration.

Report this wiki page